INTRODUCTION

The commercial unmanned aerial vehicle (UAV) marketplace is large and growing. Estimates of its worldwide size vary: a typical number is $5.6 billion in 2016 [1], while Bloomberg News projects a $127 billion value by 2020 [2]. At first glance, similarities between military and commercial drone communities appear slight, as though they are merely distant cousins connected by a common ancestor. Some military drones, particularly those used for theater intelligence, surveillance, and reconnaissance (ISR) and combat support, have no obvious relative in the commercial drone community, but smaller drones used in military applications can closely resemble their commercial cousins. While military UAVs have a mission-specific purpose from the outset, commercial drones have seen an explosion of potential applications, including some that might be created right before a specific drone takes flight. This article examines how military UAV users can benefit from the lessons learned in the development of the commercial UAV marketplace, as well as how the military’s technical acumen can aid applications in commercial industry where image quality and quantitative information satisfy critical needs.

THE COMMERCIAL UAV MARKETPLACE

The commercial UAV marketplace comprises two major categories: consumer drones and enterprise drones. Consumer drones are purchased for personal use; enterprise drones are used by businesses (large and small), universities, and public agencies, including those tasked with law enforcement, search and rescue, and fire protection. For the purposes of our analysis (to compare between military and commercial UAV markets), the focus here is on enterprise drones.

The commercial UAV marketplace is highly competitive. It includes established providers of imaging equipment as well as newer companies whose cameras are geared for specific applications, such as precision agriculture. Fixed-wing and rotary-wing aircraft are both found in this market and are selected according to the needs of the enterprise.

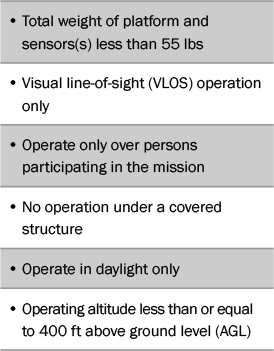

The market is highly sensitive to disruption as new technologies and strategies emerge and as Federal Aviation Administration (FAA) regulations are changed to allow greater UAV integration into the domestic airspace. Table 1 lists some of the current FAA limits for small unmanned aerial systems (sUAS) [3].

Table 1: Key FAA Requirements (14 CFR Part 107)

THE MILITARY UAV MARKETPLACE

The military UAV marketplace develops from specific missions, such as the Raven (shown in Figure 1), whose prime contractors are selected long in advance of deployment. Unlike commercial UAVs, military aircraft platform and sensor types are mission specific from the outset.

Military UAV sensors are manufactured by firms with many years experience and do not differ significantly from sensors on manned aircrafts. In fact, Global Hawk uses the same sensors formerly integrated onto U2s.

Competition among military prime contractors can be intense, but the field is necessarily limited due to the small number of airframe manufacturers. Though the market is not particularly sensitive to disruption, the military UAV community experiences the effects of disruption through the deployment of commercial drones by nonstate actors and hostile countries.

LESSONS THE MILITARY CAN LEARN FROM THE COMMERCIAL UAV COMMUNITY

Flexibility in Platform and Sensor

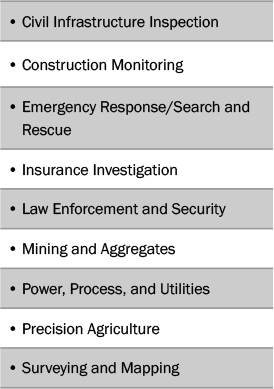

The commercial UAV market is segmented by application; several of the most important are shown in Table 2 [4]. These applications are, in turn, supported by product manufacturers, including those who develop task-specific cameras and software, and by industry consultants familiar with the needs of the end user.

Figure 1: Army Military Police (MP) Preparing to Launch the

RQ-11 Raven sUAS, Which Is Used for Short-Range Reconnaissance

and Situational Awareness (Photo Credit: Sgt. Samuel Northrup).

That the commercial UAV industry is segmented by application—and not platform—allows the enterprise flexibility. For instance, fixed-wing aircraft are often used in construction stockpile monitoring, but the hovering capability of multirotor aircraft is essential for close-in inspection tasks [5]. Tracking a suspect in a law enforcement setting might be performed with a fixed-wing drone over long distances, but monitoring that suspect’s capture and arrest is best performed by a hovering multirotor. Flexibility in sensor choices for either platform type provides an additional degree of freedom.

Table 2: Key Commercial UAV Applications

In practice, commercial application managers deploy what they have; and if they have a choice between platforms, they can use each platform for maximum effectiveness while swapping out sensors if they have more than one set. If military sUAS users were given the latitude to use more than one platform type per mission as the situation changes on the ground, as well as to swap out sensors when necessary, the overall mission result could be enhanced. In the process, data on platform type, sensors, ground activities, and mission results would be gathered. That data, when analyzed, could lead to the development of quality metrics—a task that the military is extremely good at—that could be fed back into future mission-planning activities.

Disruption as Teacher

Not only is the commercial UAV culture welcoming to disruptive innovations, the predisposition to disruption is embedded in its DNA. New innovations are quickly adapted as companies compete for market share; and the market itself widens as the FAA loosens operating restrictions.

An example of the latter may be found in precision agriculture, which is defined as “a farming management concept based on observing, measuring, and responding to inter and intra-field variability in crops” [6]. This departure from traditional farming methods makes the discipline itself a disruptive innovation. Satellite imagery or imagery gathered by aircraft over large farm areas can provide significant data to improve crop yield, but such flights are expensive. Alternatively, sUAS can gather data more cheaply (although large farms may require many flights to gather data due, in part, to FAA constraints) [7].

If the FAA’s VLOS restriction (listed in Table 1) is lifted [8], the application faces disruption. Data gathering will no longer be limited by line-of-sight but rather by battery power to the UAV and by data capacity. While number of flights will vary according to farm and UAV, fewer flights promote a higher-quality data set as these data are obtained under similar atmospheric and illumination conditions. Removal of one constraint—in this case, line-of-sight operation—can work to produce a more informative result. In the words of Roger Ohlund of SmartPlanes, a Sweden-based provider of UAV solutions, “One may conclude that we are probably right now at the beginning of what in time might be called an Agro-drone revolution” [7].

In addition, the need and desire to obtain more and better-quality data have a ripple effect throughout an industry. If battery power becomes the limiting factor in data gathering, companies wishing to stay ahead of the game will seek higher-quality battery/ power alternatives to stay ahead of their competitors. Likewise, data analytics— proprietary software that turns imagery into quantitative information for the agricultural end user—will increase in importance to where it may become the next disruptive driver. These developments will in turn drive the need for sensors offering higher performance while also reducing cost, similar to the manner in which today’s computer market has developed.

The military UAV community does not operate under FAA restrictions, but it must defend against threats from users of commercial equipment designed primarily for U.S. markets. And defeating these threats requires understanding and tracking the technology behind them. Thus, adapting military thinking to the commercial culture of disruption will facilitate a more effective approach to the threat.

Joint Ventures

The commercial world leverages expertise from smart people across disciplines to work toward a common goal; this lesson has not been lost on the military. Some military communities have already begun leveraging commercial expertise by holding “hackathons” and hacker classes, particularly in the strategically important area of command and control of a drone swarm [9] (an example of which is shown in Figure 2).

Figure 2: Small Drones Can Operate Together via a Unique Command-and-Control Structure.

Hacking the Logic Behind Drone Swarms Is Key to Countering Their Threat

(Photo Credit: John Andrew Hamilton [U.S. Army Test and Evaluation Command]).

Commercial startups are particularly good places for creativity to emerge as individuals from various backgrounds pool their expertise to develop a product or service. Recognizing this trend, stakeholders from both military and commercial communities are currently working together to identify and fund technology companies in several mission-critical areas [10]. While these developments are positive in themselves, the military’s increasing adaptation of the commercial mindset could lead to more creative use of human resources—the skills of its engineers and scientists. This author began her career supporting Department of Defense (DoD) projects and noted that the matrix management approach favored by many large military contractors worked against technologists developing technical breadth [11]. The threat, which was well-characterized in the old Cold War days, is now in flux, and strong arguments in favor of broader human resource utilization could be made.

The Dragon’s Dominance

Something happened on the way to commercial UAV market development: Chinese drone manufacturer Dà-Jiāng Innovations (DJI) became the world’s dominant manufacturer of sUAS platforms (such as the one shown in Figure 3), with some reports placing their market share at 70% [1]. This development has significantly affected many domestic manufacturers, such as 3D Robotics (3DR), which ceased manufacturing its airframes [12].

DJI has more than 1,500 employees working on research and development, according to recent market research. Moreover, electro-optical and infrared sensor manufacturers, such as U.S.- based FLIR Systems, produce cameras exclusively for use on DJI platforms [13]. Accordingly, military solution developers would be wise to consider that the next threat is likely to arrive via a DJI drone or drones from other Chinese manufacturers [1].

Figure 3: Chinese-Made DJI Drone in Use by the U.S. Air Force (Photo Credit: Wesley Farnsworth).

LESSONS THE COMMERCIAL UAV COMMUNITY CAN LEARN FROM THE MILITARY

High-End Hardware and Evaluation of Image Quality

Manufacturers of commercial drone cameras include those who provide cameras to a variety of markets (e.g., FLIR Systems and Sony) as well as companies who develop hardware only for drone applications. Not surprisingly, prices vary widely, as does image quality.

Not all the applications listed in Table 2 require high-quality imagery, as processed imagery from lower-quality cameras is sufficient for many tasks. Construction stockpile monitoring, for instance, will not suffer when highly processed imagery corrected for camera defects is used, and cameras costing a few hundred dollars can provide data to high-end mapping software that includes adjustment for known lens distortions [14].

In other applications, high data quality is essential. The General Image Quality Equation (GIQE) [15], which depends on the signal-to-noise ratio in unprocessed imagery, and the National Imagery Interpretability Rating Scale (NIIRS) value it predicts [16] are related to the three major discrimination tasks of detection, recognition, and identification, which are essential in military applications. Civilian applications such as agriculture, search and rescue, and infrastructure monitoring also benefit from high-quality imagery [17]. Figure 4 shows two military police performing a prelaunch checkout of a system designed to gather high-quality data.

Figure 4: Army MPs Perform Pre-Launch Checks of a Raven sUAS.

The Raven’s High-Quality Imaging Sensors Provide Data Used by

Military Missions to Maintain Situational Awareness in Daytime and Nighttime Conditions

(Photo Credit: Sgt. Samuel Northrup).

Law enforcement is perhaps the key civilian area in which image-quality metrics will play a role. Imagine a trial in which a suspect is charged with a crime based on imagery gathered by a drone (such as the one shown in Figure 5) during a civil disturbance [18]. If the drone camera is of low quality with known optical distortions, a defense attorney could legitimately argue that the processing software identifying his client as the suspect led to the wrong party’s arrest. Cameras must also provide imagery of a quality sufficient to identify and distinguish between phenomena that may arise during a civil disturbance, such as debris reflection and the signatures of explosive devices.

Figure 5: An sUAS Used by Police in Colorado (Source: U.S. Department of Justice/ AeroVironment Inc.).

The best data analytics in the world will be of dubious value when applied to imagery that is substandard in the first place. The fact that drone case law development is in the beginning stages motivates the need to understand and quantify technical performance. This is an area in which the commercial UAV marketplace, particularly in law enforcement, can learn from military development.

The Need for Accurate Radiometric Calibration

A radiometric calibration associates a physical quantity, such as the radiation received by an imaging sensor, with the sensor’s output signal. The DoD, its contractors, and university partners have developed precise techniques for calibration; many of these are in the infrared portion of the spectrum and aid discrimination applications and target signature determination.

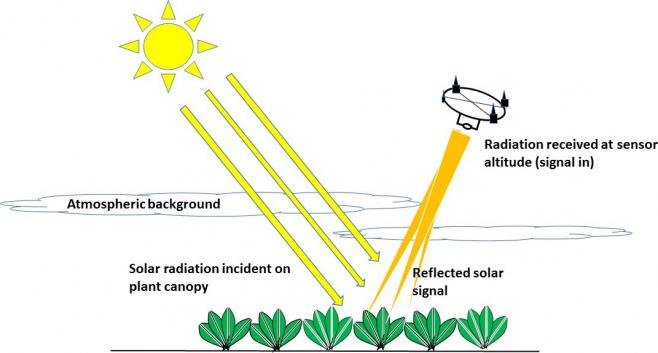

Atmospheric correction is necessary when the desired result of imaging is quantitative data on the ground, provided by the process diagrammed in Figure 6. The atmosphere is not a perfectly transmissive window, even on a so-called “clear day.” To solve this problem, military components have developed and improved upon radiative transfer codes (models), which correct for atmospheric effects in the imaging sensor’s output signal.

Figure 6: Agricultural Remote Sensing Configuration. The Solar Signal Reflected From a Plant Canopy Passes

Through the Atmosphere to the UAV. A Calibration Function Infers the Input Signal’s Value

From the UAV Sensor’s Output (Source: Grant Drone Solutions, LLC).

Several commercial companies manufacture cameras specifically for precision agriculture. They claim to provide calibrated imagery [19] but do not account for the transmission of the atmosphere in their literature. Without accounting for atmospheric transmission, reflectance values are not absolute. In some locations, this difference is significant, such as California’s Central Valley agricultural region in which thick Tule fogs [20] lie close to the ground several months of the year.

If the commercial UAV community applies the results of military-derived atmospheric codes, they will receive more accurate data for their models and maps. When the FAA raises the commercial drone operating height limit, the need for correct atmospheric information may become another disruptive driver in precision agriculture.

CONCLUSION

Many commercial UAV image-gathering applications require only a “pretty picture,” but for applications requiring high-quality imagery and radiometrically calibrated data, the military UAV community is far ahead of the commercial drone world. Furthermore, imaging sensor developers who produce for both military and commercial markets are ahead of the game in delivering high-quality data, but their products usually cost more than cameras manufactured for specific commercial markets.

As discussed, the military UAV community can learn from the commercial drone world in several significant areas, including the need for rapid adaptability and response to disruption. While adaptability in the commercial space is tied directly to market share, the military requires adaptation to new and changing threats. Partnering with commercial industry to develop data analytics, hackathons, and joint venture funding for promising technologies demonstrate the DoD community’s willingness to adapt.

These two communities—military and commercial—seem far apart on many key issues relating to UAV deployment and data use, but that need not be the case. Each can learn from the other. And when that happens, the military will see rapid adaptability to changing threats, and the commercial world will benefit from high-quality imagers and the standards necessary to accurately interpret their data.

References:

- Joshi, D. “Commercial Unmanned Aerial Vehicle (UAV) Market Analysis—Industry Trends, Companies, and What You Should Know.” Business Insider, http://www.businessinsider.com/commercial-uav-market-analysis-2017-8, 8 August 2017.

- Moskwa, W. “World Drone Market Seen Nearing $127 Billion in 2020, PwC Says.” Bloomberg Technology, https://www.bloomberg.com/news/articles/2016-05-09/ world-drone-market-seen-nearing-127-billion-in-2020-pwc-says, 9 May 2016.

- Federal Aviation Administration. “Summary of Small Unmanned Aircraft Rule (Part 107).” FAA News, https:// www.faa.gov/uas/media/Part_107_Summary.pdf, 21 June 2016.

- Karpowicz, J. (editor). Commercial UAV News. https://www.expouav.com/news/, accessed 14 February 2018.

- Salmon, J. “Secrets to the Successful Selection of a UAV Platform.” Commercial UAV News, https://www. expouav.com/news/latest/secrets-successful-selection-uav-platform/, 19 October 2016.

- Wikipedia. “Precision Agriculture.” https:// en.wikipedia.org/wiki/Precision_agriculture, accessed 27 December 2017

- Ohlund, R. “Precision Agriculture Utilizing UAVs.” SmartPlanes website, http://smartplanes.com/precision-agriculture-utilizing-uavs/, 20 April 2017

- [8] McNabb, M. “Is BVLOS Flight Getting Closer in US? Drone Industry Thinks So.” dronelife, https://dronelife. com/2017/08/31/bvlos-flight-getting-closer-us-drone-industry-thinks/, 31 August 2017.

- Schuman, J., and E. Hall. “UAS Threats, Solutions, and the Collaboration Imperative.” DSIAC Journal, vol. 4, no. 2, https://www.dsiac.org/resources/journals/dsiac/ spring-2017-volume-4-number-2/uas-threats-solutions-and-collaboration, spring 2017.

- Defense Innovation Unit Experimental. DIUx website. https://www.diux.mil/team, accessed 16 January 2018.

- Wikipedia. “Matrix Management,” https:// en.wikipedia.org/wiki/Matrix_management, accessed 9 January 2018.

- Glaser, A. “DJI Is Running Away With the Drone Market.” recode, https://www.recode. net/2017/4/14/14690576/drone-market-share-growth-charts-dji-forecast, 14 April 2017.

- FLIR Systems. Zenmuse XT Product Brief. https:// www.flir.com/browse/industrial/aerial-kits/, accessed 28 December 2017.

- Peters, J. “Move from Drones to Maps: Unmanned Aerial Systems Support for ArcGIS.” 2017 Esri Public Sector CIO Summit Proceedings, http://proceedings.esri. com/library/userconf/ciosummit17/papers/ps_cio_15. pdf, 30 March 2017.

- Griffith, D. “General Image Quality Equation (GIQE).” National Geospatial Intelligence Agency Briefing, https:// calval.cr.usgs.gov/wordpress/wp-content/uploads/ Griffith_Doug_JACIEGIQERev3cor2sjs6with-Caveat.pdf, 18 April 2012.

- Grant, B. Getting Started with UAV Imaging Systems: A Radiometric Guide. SPIE Press, https://spie.org/Publications/Book/2239236?SSO=1, July 2016.

- Federation of American Scientists. Civil NIIRS Reference Guide. https://fas.org/irp/imint/niirs_c/guide. htm#12, March 1996.

- Grant, B. “Imagery Analysis: Standards Needed for the Drone Age.” SPIE Newsroom, http://spie.org/ newsroom/5594-imagery-analysis-standards-needed-for-the-drone-age?SSO=1, 21 August 2014.

- Parrot Sequoia. Marketing Material. https://pix4d. com/wp-content/uploads/2016/02/Sequoia_Flyer.pdf, accessed 31 December 2017.

- Wikipedia. “Tule fog.” https://en.wikipedia.org/ wiki/Tule_fog, accessed 15 January 2018.